Due to the rise of digital platforms, the Banking and Financial industry experience great transformations. One of the biggest trends in the modern economy is the ability to fulfill a transaction between clients and providers directly – the process of Uberization. What does it bring to the end-users and the economy? What are the predictions and risks of such a trend for P2P lending? That’s what we are going to explore in this article.

Uberization in Fintech

In a world where the amount of information is growing, it becomes challenging for the consumer to analyze it and choose the best option from the many financial institutions, each processing its specifics. To make things easier, people turn to intermediaries.

Technology innovation brings more notions, but the name of a company rarely becomes a verb. Google is probably one of the most famous examples of this phenomenon, but now we have another trending notion that became popular in the Fintech industry, that derived from the Uber name and may change the whole economy. Uberization began a revolution in customer-performer interaction. Services and marketplaces freed us from the need to independently search and verify the reliability of service providers. Remarkably, the trend has affected not only the private users – but has also affected the B2B sector, making it as easy to get services for industrial needs as ordering a taxi.

We can generalize the notion of uberization, as the process of transferring interactions between clients and providers of services to a digital platform that creates additional value for buyers and sellers using information technology.

Let’s highlight the main features of the business model built in the process of uberization:

- The creator of an Uber-like business clearly defines the rules for the interaction of players in the market and controls their implementation by all participants.

- The entire interaction process is carried out using a digital platform based on a mobile application. The effectiveness of interaction between market participants should not depend on the time of day and their location.

- All business processes are automated and optimized as much as possible.

- The digital platform and rules of engagement create additional value for market participants that they wouldn’t have gotten outside of Uber. For example, the ability to track taxis, a system for assessing the reputation of performers, guarantees when concluding transactions, saving time to search for orders, etc.

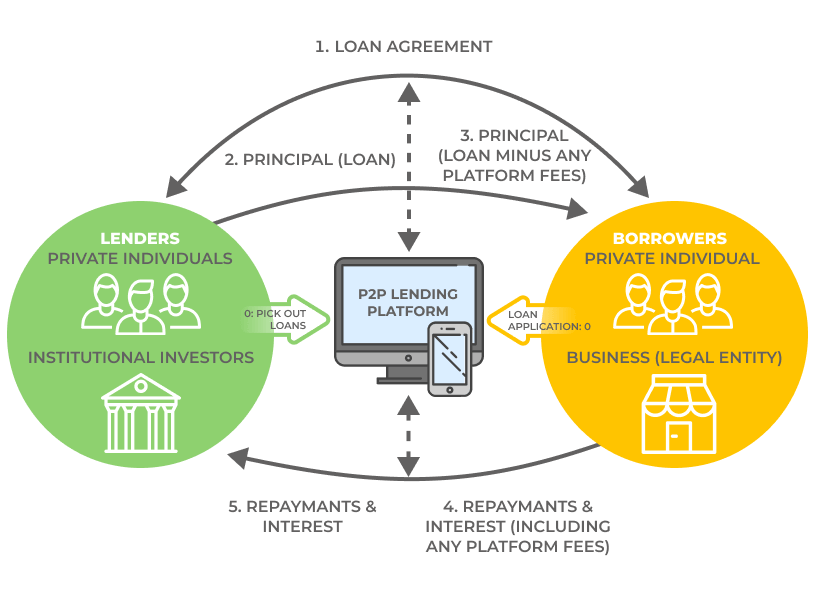

Nowadays, we can witness how uberization developed in P2P lending. This process usually involves an investor who loans money directly to a borrower through an online platform. In this model, individuals can lend to other individuals or businesses without any financial institutions. Online platforms accumulate all kinds of lenders and borrowers, who can meet and offer mutually beneficial terms. It makes it possible for the potential lenders and borrowers to register on various P2P platforms, from Internet resources to programs, and conclude the loan agreements, determining their terms and negotiating debt and repayment terms.

The challenges and benefits of uberization

If we talk about some ideal model of uberization, then any “uber” as a service provides a huge number of advantages for both consumers and businesses. First of all, this is a guarantee of the best price, the speed of service delivery. Uberization allows you to significantly save on internal business processes associated with the provision of services by agents. But, in addition, this model makes it possible to start a business for people who have never been involved in it. Thus, their clients risk getting low-quality service.

Challenges of uberization for P2P lending:

- The emergence of new digital industries prompts the government to stimulate and support the uberization process. But it doesn’t exclude the possibility of introducing restrictions in this area. The main goal of any state is to make business on its territory work as efficiently as possible both financially and socially and to develop new technologies that change the familiar world. The limit of the technological growth of the project comes where entrepreneurship begins to violate the rights of consumers.

- The regulation of P2P lending in Europe and the USA is disintegrated. Different government bodies are responsible for investing and borrowing side of these platforms. For example, the Securities and Exchange Commission (SEC) in the USA is in charge of the investing side, while the Consumer Financial Protection Bureau and the Federal Trade Commission exist to monitor the borrowing side. As legal lenders, the lending platforms are responsible for complying with laws regarding the loan, explaining the declination of credits, and avoiding unfair debt collections.

- The process of uberization involves a complete restructuring and “reengineering” of the existing model of the market. Even if the transition to the new system increases the efficiency of production and consumption of goods, it will face resistance from people who benefit from operating within the existing institutional system, as well as the problem of network effects.

- The P2P lending interest rates are usually higher than at mainstream banks, sometimes into the teens.

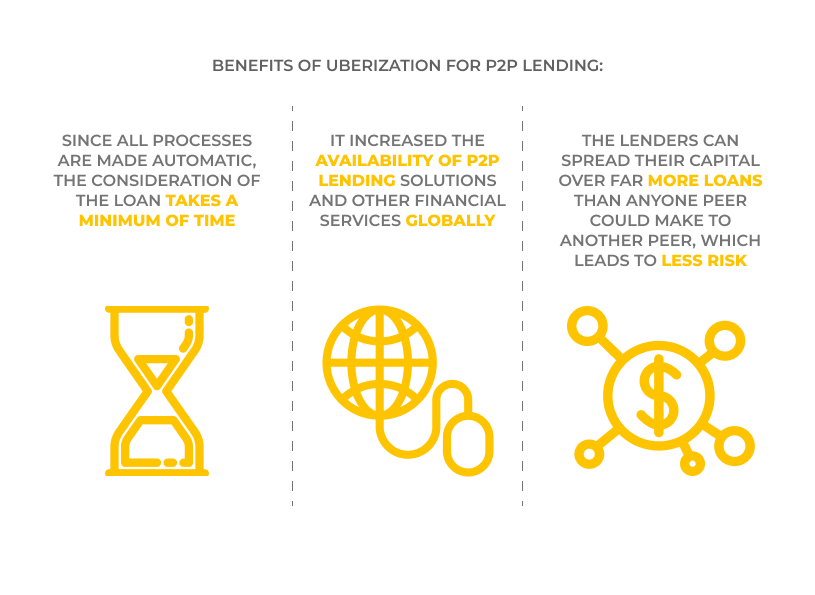

Benefits of uberization for p2p lending:

- The uberization of P2P lending solutions solves the speed of obtaining a loan, as one of the main claims to banks usually is a long period of application’s consideration. Since all processes are made automatic, the consideration of the loan takes a minimum of time. The borrower doesn’t even need to leave the house, as the money can automatically be transferred to his account.

- The uberization had a great impact on the financial industry, as it increased the availability of P2P lending solutions and other financial services globally. People who didn’t have access to banking services now obtained such possibility and take advantage of the services even from different countries.

- People who need great sums can easily get funds from small individual lenders searching for a high return. Thus, the lenders can spread their capital over far more loans than anyone peer could make to another peer, which leads to less risk.

Digital security

A separate topic for research may be the problem of information security that inevitably appears between the participants in any interaction system based on a digital platform.

On the one hand, the development of Fintech leads to the increasing of frauds’ options to acquire data. On the other hand, Fintech companies are developing solutions to protect against cyberattacks and try to include all possible vulnerabilities at the design stage of the next digital product. Fintech companies try to use all modern technologies and AI to protect the financial markets, for detecting and counteracting cyberattacks before they cause harm and faster data recovery.

Keeping in mind the challenges of the Fintech industry, think of the best practices and the latest approaches that can help your company to deal with the concerns and protect valuable data within your Fintech product.

Due to the interrelated global trends and possible financial risks that banks can face, the innovations enable large organizations to process high data volumes more efficiently and rationally:

- The regulators are constantly reviewing the rules, expanding them, and responding to threats from both organized crime and the growing threat of global terrorist networks, many of which have become stronger and more complex in recent years;

- Integrated networks and an increase in the number of cross-border operations have created gaps in the infrastructure of banks, increasing their vulnerability;

- The work of banks is affected by the wider use of economic sanctions for individuals due to foreign policy;

- Regulatory authorities are wary of potential threats, and their increased expectations entail the creation of demanding regulatory conditions for banks and financial institutions.

There are also technical issues and privacy risks that can relate to information security and can affect investors of P2P lending in the following way:

- Investors can experience a loss of funds

- Investors can lose access to the funds

- Investors can suffer from identity theft because of unauthorized access

- Investors can undergo the unauthorized change of deposit details, interest or principal values, or withdrawal of funds.

Both investors and platforms can forward these risks through detection, prevention, response, reduction of impact, technical and organizational restrictions, creating an audit trail. By identifying a user’s complete digital profile, including email addresses, geolocations, devices, online lenders can more effectively differentiate between fraudulent and authentic activity without putting off the customer experience.

Predictions and statistics

The evolution of technology and its impact on the banking system is huge, the technology greatly impacted the real existence of banks as financial intermediaries. The banks’ role changed, technology has already challenged two main financial concepts:

- Money circulation: banks have always ensured certainty and predictability in the circulation of money.

- Credit capacity: attitude of banks to repackage risky assets in form of risk-free deposits thanks to their experience, competence, and technology.

The growth of P2P lending is obvious all over the world, and even despite its dynamics are not so impressive, and the growth does not exceed 4.4%, the future of banks will in any case be centered around this most traditional type of business.

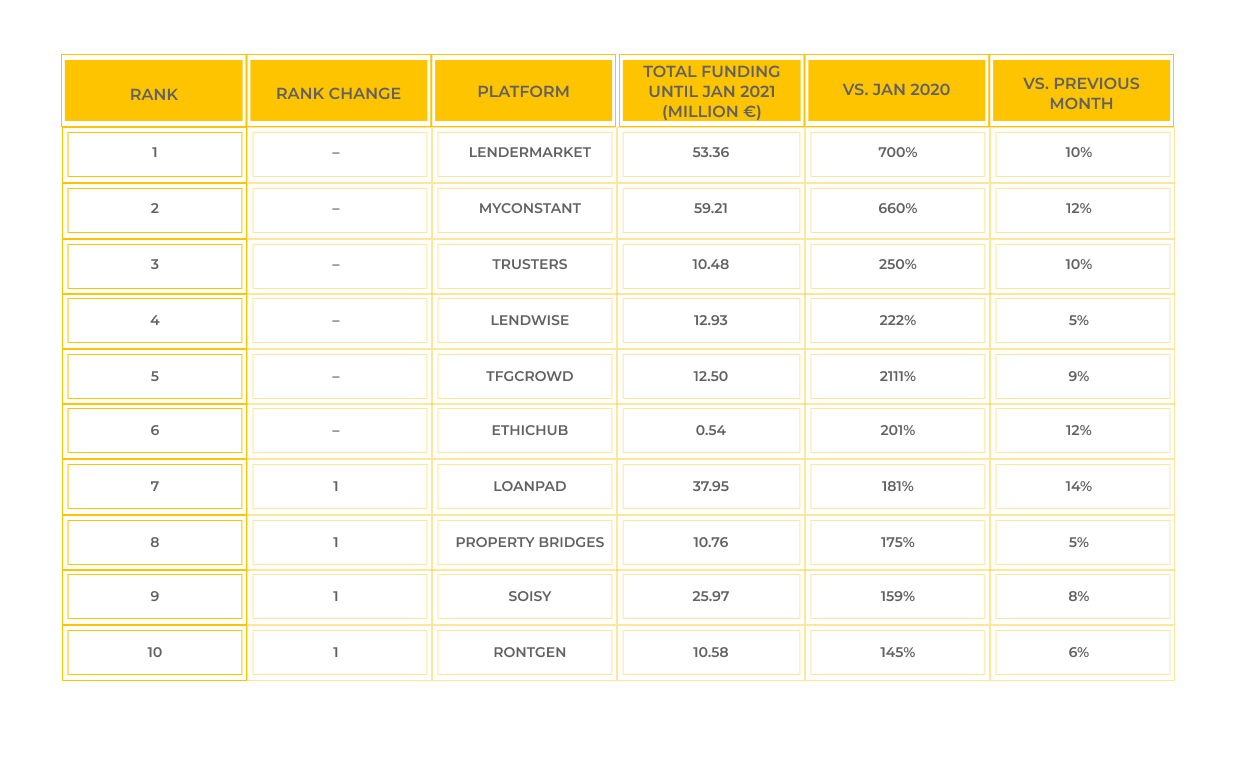

The P2P lending market contains hundreds of platforms. And each year, more and more new different lending platforms go to market. Here are the main highlights of 2021 in data.

This table represents 10 platforms that have grown the most over the past year. Most rising platforms come from Europe (7 out of 10) and all tend to be startups with short track records and still low total volumes. Two platforms especially stand out: Lendermarket – a European consumer loans marketplace, and MyConstant – an American crypto-based P2P lending platform. Both are rather new in the lending business, having launched in 2019 and both are showing outstanding growth rates (700% and 660% respectively).

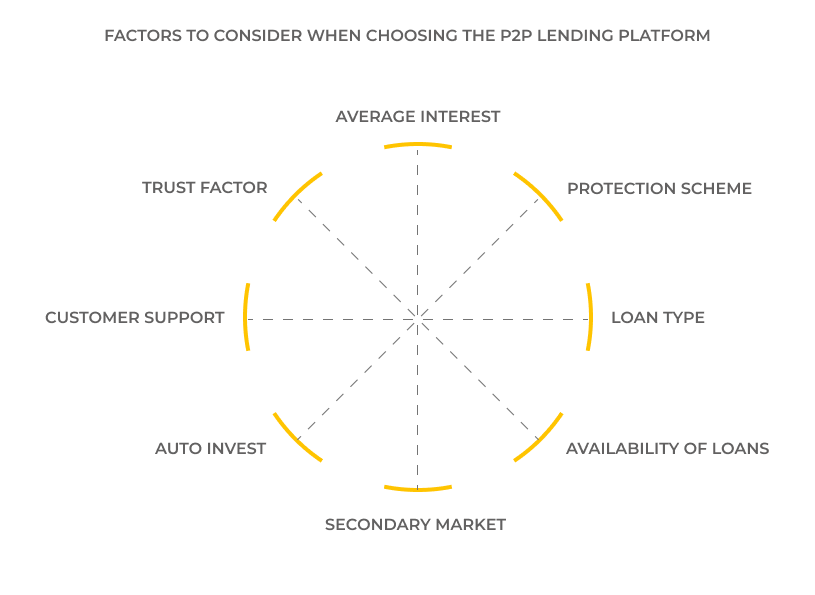

When choosing the P2P lending platform, the users need to take into account such factors as:

- Average interest

- Protection scheme

- Loan type

- Availability of loans

- Secondary market

- Auto invest

- Customer support

- Trust factor

The uberization model of the economy is a modern trend, which is a promising and radical replacement for the existing system of economic relations between counterparties, which has developed in the previous technological structures. The use of the business uberization model obliges the company to change the process of interaction by introducing information technologies, developing its information platform and a mobile application for direct communication between clients and providers. The automation of the operations will lead to the lack of demand for several professions. The timely response of the economy to a structural change in the processes of selling goods and services can lead to the change in the content of labor and the appearance of new professions.

The uberization business model changes not only the outlook on the economy of the future but also affects the system of institutional rules, methodology for making management decisions and developing strategies, organizational form, and relationships, providing opportunities for growth through constant disruptive innovations that allow changing faster than the external environment.

How UppLabs can help

Over the last 7 years, we at UppLabs mastered the latest Fintech technologies and gained experience in creating reliable, secure, and sophisticated Fintech solutions and P2P lending products, such as the Neofin platform that allows earning on the resale of loans and micro crediting and offers such modules as:

- 3D/2D Liveness Detection for client identification protection against hacking biometric systems;

- Bank ID to verify clients through banks to provide administrative and other services via the Internet;

- Financial monitoring of the client’s financial transactions and its compliance to his financial state;

- Customer identification scoring that allows automatic status affixation of the applicant, based on analysis of available databases and statistics;

- AI&ML for making business decisions with mathematical precision based on big data analytics from open sources;

- The automated accounting system for financial companies (AFS), a complex of software and hardware aimed at automating financial activities;

- The system of loan repayment through online services, self-service terminals, and cash banks;

- The CRM system keeps a full record of applications for credit products with the ability to track and record the status of the application, a complete history of interactions with the client;

- SEO page configuration constructor etc.

Regardless of your location, we thoroughly examine the Fintech regulations as far as almost every Fintech solution and standards developed these days can go globally. Also, you should be sure to partner with developers that are aware of Fintech development standards and limitations. We provide the following solutions:

- Fintech web and mobile development

We follow Fintech trends and innovations, constantly learn, visit the best fintech conferences, and have the best team of professional web and mobile developers. - Money transactions platform engineering

Our fintech payment ecosystem is transparent and multifunctional. - Online trading and exchange platform engineering

We create online e-trading platforms that offer real-time solutions with various trading fintech opportunities. - AI-based Fintech solutions

We are ready to use AI-based solutions to collect and process huge volumes of data aggregated by Fintech companies. - Payment systems integration and optimization

We automate your accounting and ERP creating the best fintech services and apps. - Existing services maintenance and modernization.

Our portfolio includes the use of modern architecture that guarantees easy maintenance and easy integration with the best fintech services.

If you need a P2P lending solution or a custom Fintech software development – ask UppLabs!