In large ecosystems, all participants influence each other. Therefore, the response to cyberattacks and counteraction is a primary task of every company, as well as its clients.

Despite the constantly growing number of cyberattacks worldwide, a great number of breaches could be prevented if companies could minimize cyber threats and use security best practices on time.

If you have a Fintech startup and are eager to know what it means for your business and what security practices for Fintech projects you can follow to protect the software and data, keep reading!

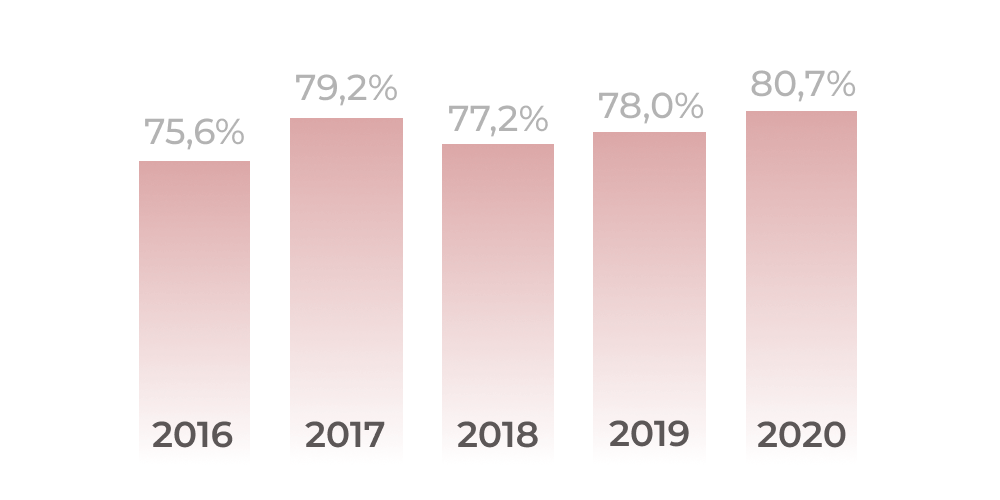

Statistics concerning cybersecurity

Fintech is a new tech industry of the economy that includes applications, websites, and other technological solutions that modernize traditional financial services. But it is thriving for both startups and hackers.

Before getting to know more about the best fintech security practices, let’s explore the latest statistics concerning cybersecurity in recent years to understand what we are dealing with.

Here are some figures to consider:

- 144.91 million new malware samples were delivered in 2019 and 38.48 million new samples are already delivered in 2020 (by May);

- Malicious hackers are now attacking computers and networks at a rate of one attack every 39 seconds;

- 81% of organizations were affected by a successful cyberattack in 2019;

- In 2020 more than two-thirds of IT security experts think that a successful cyberattack is imminent;

- Small organizations get malicious emails at a higher rate comparing to big enterprises;

- Tuesday is statistically the most popular day for phishers to conduct their campaigns while the least popular day is Friday;

- Over 60% of online fraud is performed through mobile platforms;

- Over 75 percent of large companies still rely on the antivirus software that was pre-installed on their computer equipment;

- The most affected industries by breaches targeting payment card data are retail (24%) and finance and insurance (18%).

Major Fintech Security challenges

As we can see from the statistics above, the Fintech industry is highly vulnerable to security attacks. No wonders. It deals with tons of delicate and important financial information like passwords, bank accounts, identity data, etc.

To get the idea of the most effective and successful security practices for Fintech projects, we need to explore the main security challenges. Here we highlighted some of the most critical ones:

1. Digital identities

The digital identity verification market is predicted to reach $12.8 billion by 2024, despite the fact that digital IDs are still not so frequently used today. But the security of IDs is a permanent customer concern that still relies on password-based systems or 2FA processes that are vulnerable to cyberattacks. To improve already existing biometrics technologies, Fintech companies use one-time passwords (OTP), as well as risk-based authentication. This adaptive authentication analyses such data as a user’s geolocation, registered devices, biometric data, OTP, and many more.

2. Data ownership

Fintech businesses that work with sensitive data have to develop a procedure for regulating who can access, create, change, and remove data, as well as granting these rights to others. Data ownership smoothes the litigation in case information is leaked as you can see who is responsible for the data’s security. While providing data ownership in your startup, you have to consider lots of technical and legal processes as well as its compliance with the standards and regulations in your country.

3. Cloud migration

Fintech companies depend on cloud solutions for better performance, scalability, availability, and costs optimization. However, as data transfers in different environments, it’s getting harder to supervise it. Especially for the Fintech industry, it is essential to choose tools that can manage your cloud solutions in full integrity. As it happens that increasing involved parties and technologies can lead to multiplying vulnerabilities.

4. Third-party components

Integrating with third-party components like payment gateways, analytics systems, social network buttons, chatbots can compromise the security of your Fintech product. It’s recommended to decrease their number or develop these components from scratch. If you need some complex functionality that is beyond your expertise, then choose reliable partners and vendors that you can constantly monitor.

5. Compliance with security protocols

Your Fintech startup has to be in compliance with the regulations and standards of the country of its regulations. The increased awareness of the value of data in the digital economy caused the necessity to initiate the new value propositions for the customer, taking in mind their privacy concerns. This resulted in creating two regulations in Europe: the General Data Protection Regulation (GDPR), and the ePrivacy regulation, that addresses the issues of data resulting from web communications, such as requirements for consent to the use of cookies, site logs, etc.

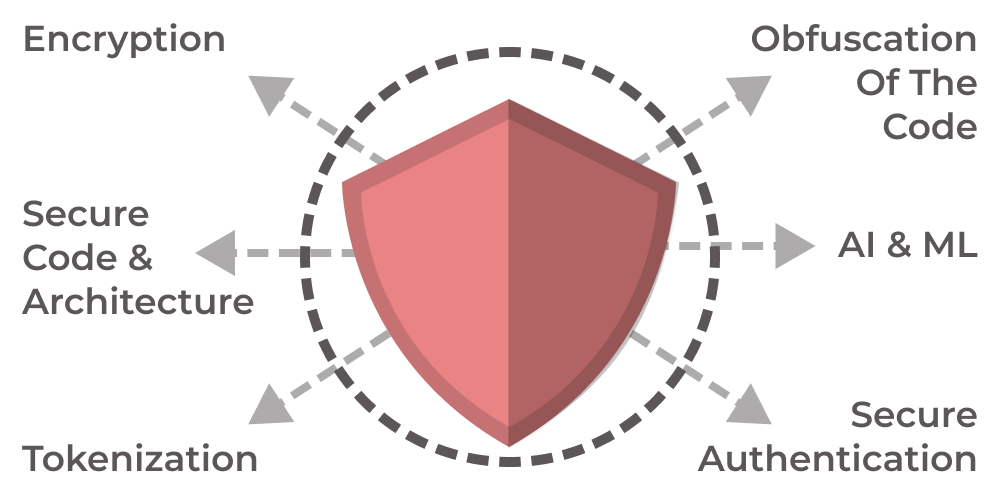

How to protect data in Fintech projects

Keeping in mind the challenges of the Fintech industry, let’s think of the best practices and the latest approaches that can help your company to deal with the concerns and protect valuable data within your Fintech product.

- Use encryption of sensitive data

Encryption involves mathematical algorithms to encode data with a help of special keys. These are the most powerful encryption algorithms to consider:

– Advanced Encryption Standard (AES);

– Triple Data Encryption Standard (TripleDES);

– Rivest-Shamir-Adleman (RSA);

– Twofish

- Make use of AI and ML

Besides improvements in automation thanks to algorithms, AI and ML can also be used for the reliability of potential clients. While businesses want to reduce the use of sensitive personal data, hackers might use these loopholes to misuse some financial systems or create fake identities. In this regard, AI and ML provide trusted credit estimation of users and transactions to detect inconsistency while companies can save on labor costs.

- Apply tokenization

The token is a replacement for a piece of sensitive information, like one’s credit card number. Instead of using real data, systems create tokens that connect with real data, but in an encrypted way so that you can’t reverse to the original data. These tokens are created for temporary use, so they can expire after a single-use. This allows Fintech companies to avoid situations when someone can track sensitive data through transactions.

- Provide secure code and architecture

Messy code can never ensure security. Choosing a technology stack for your Fintech projects is also important. It can to reliable, scalable, well-supported, of course, secure. Our team works with various databases and APIs. With the help of the latest technology stacks and technical skills of our developers, we are creating solutions that streamline your business operations, deliver values, and ensure the security of Fintech products on all possible levels.

- Create secure authentication

Secure identification and authentication can be critical for FinTech software. To provide secure code and secure architecture your startup can apply the following approaches:

– Role-based access control (RBAC) – access to software and systems according to a user’s role. Each type of role has access to its files and processes and is restricted from other parts of the software.

– Password expiration – regular change of passwords can reduce the risk of data leaks and the use of previous employees.

– Tracking and setting a limit for sign-ins – failed sign-ins allow you to prevent cyberattacks.

– Shorter session lifetimes – duration of time when the user can be signed in to the system that you can control.

- Use code obfuscation

Fintech companies can use code obfuscation to protect their software from cloning. Program clones can seem very similar to the original software, so they can manage to collect users’ personal data. The process of obfuscation makes it difficult for hackers to analyze the app’s code and understand the work of algorithms as well as prevent reverse engineering. By using a code obfuscation, you can protect against trade secret theft, unauthorized access, bypassing licensing, as well as vulnerability discovery.

How we can help

Regardless of your business, Fintech security practices are one of our priorities. Over the last 5 years, we at UppLabs mastered the latest Fintech technologies and gained experience in creating reliable, secure, and sophisticated Fintech solutions and products:

- Fintech web and mobile development

We follow Fintech trends and innovations, constantly learn, visit the best fintech conferences, and have the best team of professional web and mobile developers.

- Money transactions platform engineering

Our fintech payment ecosystem is transparent and multifunctional.

- Online trading and exchange platform engineering

We create online e-trading platforms that offer real-time solutions with various trading fintech opportunities. - AI-based Fintech solutions

We are ready to use AI-based solutions to collect and process huge volumes of data aggregated by Fintech companies. - Payment systems integration and optimization

We automate your accounting and ERP creating the best fintech services and apps. - Existing services maintenance and modernization.

Our portfolio includes the use of modern architecture that guarantees easy maintenance and easy integration with the best fintech services.

If you need IT consulting on Fintech – ask UppLabs!