The globalization of the world economy is growing steadily, which requires more straightforward access to banking services from anywhere. Neobanks are becoming so successful in modern society because they meet the expectations of consumers. Today, everyone has the opportunity not to go to the bank every time they got an issue. Numerous work tasks are concentrated in the mobile and browser interfaces. What neobanking trend challenges do we expect for software development in 2021?

The Rise of Neobanks

A Neobank is a Fintech-based bank that operates digitally or via a mobile app and provides banking and payment services without the traditional bank infrastructure. Typically, neobank includes real or virtual payment cards, mobile deposits, individual payments using phone numbers, emails, social media IDs, mobile budgeting tools, and real-time digital receipts.

The history of the transition of banking services to cyberspace began a long time ago. One of the first neobanks was the British First Direct Bank, which launched telephone banking in 1989. The bank was the first to apply the concept of work without branches, serving customers through a call center. By May 1991, more than 100,000 customers used these innovative bank’s services. Today First Direct Bank is a division of HSBC Bank plc.

With the development of the Internet, banking institutions have often sought to reduce operating costs by offering customers Internet banking services. In 1998, the Egg Internet Bank was founded in the UK. With the help of the call center and the Internet, customers could manage their accounts. Thanks to the convenient service, the bank soon had more than 2 million customer accounts.

Since the mid-2000s, online and telephone banking have become the basis of retail banking services. Most banks have taken this into account by including such online stores in their core products while changing or reducing their branch networks. However, a new wave of full-featured neobanks has swept the world market only in the last five years.

Top World Neobanks

Among the most famous neobanks in the world are the following:

- Atom Bank was founded in 2014 in the UK. In 2015 the bank received a full banking license. Atom Bank was fully launched after the restrictions on regulation were lifted in April 2016. Atom Bank has no bank branches or traditional web banking. The full service is provided through a mobile application, offering login using face and voice recognition. The bank allows remote opening of deposits and processing of loans. The clients can also get a mortgage.

- WeBank is an Internet banking subsidiary of Chinese Internet giant Tencent Holdings Ltd. It is the first digital bank in China to be launched in early 2015. Its service is closely linked to the WeChat social network ecosystem and provides a wide range of services (from payments to microcredit).

- Simple is known initially as BankSimple, is a US neobank founded in 2009 that works with Compass and Bancorp for banking services. Simple provides accounts and is part of the STAR network for free access to approximately 55,000 ATMs.

- Fidor Bank was established in Munich in 2009. It is a German bank that uses exclusively digital technologies, whose banking services are aimed at solutions for the digital generation. Fidor Bank started in the UK in September 2015, applying for a UK banking license in January 2015. Under a German license, Fidor Bank serves more than 120,000 account holders and around 350,000 registered community members. In 2014, Fidor became one of the first banks to use the Ripple payment system protocol.

- Starling Bank is a neobank headquartered in London. Starling is a licensed mobile bank founded in 2014. Starling services focus on providing current accounts. The mobile app offers intelligent solutions for smarter money management and real-time monitoring.

- Monzo is an online bank based in the United Kingdom. It was one of the earliest of a number of new app-based challenger banks there. Now Monzo claims to have 4.2 million customers.

The Challenges of Neobanks

Rapid technological progress changes the neobanking sector as well as brings the new challenges:

- Breakdown of differentiators. Neobanks are trying to differentiate themselves by creating very distinguishing packages of services and features.

- Regulation raises the barrier for everyone. Throughout Europe, the Fintech industry’s compliance practices differ from country to country and fall within several jurisdictions.

- Big banks own neobanks. Neobanks either obtain a banking license themselves or operate based on one of the existing banks, essentially buying services in bulk from the approved financial institution and selling them at retail to their customers.

- Security challenges. Neobanks deal with tons of delicate and essential financial information like passwords, bank accounts, identity data, etc. Integrating with third-party components like payment gateways, analytics systems, social network buttons, and chatbots can compromise any product’s security.

- Convincing enough people to switch = neobanks need to achieve profitability as quickly as possible. For the neobanks to make some profit, they need to create a great customer base, which means they need to make people want to change their accounts from other neobanking providers.

- Coronavirus impact. The Covid-19 pandemic influenced almost every business in the world. In times of crisis, consumers tend to take much fewer risks. People’s use of neobanks dropped dramatically at the start of the UK’s lockdown. The lockdown showed digital banks’ dependency on interchange fees and travel for revenue. On the other side, customers started to use more mobile apps, experiencing the inability to access the bank branches.

Although some neobanks, even with a relatively small user base, were acquired by some big banks (for example, Simple was bought for $117 million by the Spanish banking group BBVA in 2014, with only 100,000 customers) or attracted large investment rounds (Monzo recently attracted £19.5 million at an estimated £65 million), the question of the growth path of such neobank remains open.

Main Predictions for Digital Banking

- Neobanks and financial institutions will use all possible users’ data to fully understand customers’ lives and needs and personalize the services using AI (Artificial Intelligence).

- By 2030, the world will become more hyper-connected. Consumers will interact with service providers through voice and personal assistants, face recognition systems, and wearable devices.

- Big Data, ML, and AI will allow banks to move from providing the usual “financial service” tool to a more proactive role of “facilitation needs.” Imagine that the neobanks will independently switch your subscriptions to non-banking services because they have found a better offer than your current provider.

- Algorithms of ML and data models will be built around optimizing customers’ financial decisions. They will often encourage people to behave positively, “pushing” them to specific actions that will have a positive financial result.

- Digital currencies will improve the convenience and speed of payments and allow customers to launch innovative services.

- Banks will need to go beyond “money” and integrate with the broader ecosystem of alternative services.

- In the age of cyber fraud (the use of AI to model the human face in the video, advanced cybercrime, data theft, blackmail, phishing, and other realities of the digital age), users will get the platforms they can trust.

- Awards, partnerships, and loyalty points will be the key differences between payment products. Unique payment solutions will automatically tell customers which payment method to choose – points, bonuses, non-cash – to get the most out of your purchase.

- By 2030, cybersecurity will be built on projected enterprise-wide analytics, security vulnerabilities, and AI threat detection. Imagine that AI rethinks the vulnerability assessment of the Internet security system and configures it in real-time, not allowing hackers to exploit the vulnerabilities.

- People will stop using tokens, mobile phones, or smartwatches for storing digital personal and biometric data in favor of personal items, such as interactive glasses, rings, earrings, or cufflinks.

- Blockchain will address customer data privacy through distributed data warehouses, which will allow people to fully control their private data and share it with third parties in case people have agreed to it.

- The rise of digital currencies and tokens issued by central banks and corporate players will further accelerate the transformation of products and services. This digitization of money will bring greater financial inclusion to the world’s population, greater transparency, and better processing and settlement of real-time transactions.

Is there anything technology can help with?

Neobank is already a technology aimed to make your product more successful, affordable, safe, and fast. The traditional banking models don’t always work in the modern world. They need to change to provide all kinds of consumer services while using a more cost-effective and interactive approach. There were cases when some neobanks have failed to move fast because their platforms appeared to be not so adjustable or flexible. To re-engineer these solutions, develop the service and expand the markets, the companies have to spend more resources.

Thanks to the technology, neobanks can experience the following practical functionality and features:

- Transferring money to other accounts in a few clicks;

- Splitting bills easily;

- Fast international payments;

- Splitting money into several accounts;

- ApplePay function;

- Setting a joint account;

- Security and control over spending;

- Fee-free cash withdrawal;

- Calculating interest rates;

- Immediate customer support;

- Getting full history of purchase;

To provide positive services, neobanks need to overcome several challenges, like:

- A lack of initial resources;

- Pressure of competing with other neobanks;

- Create a large customer base;

- Сompile with regulations;

- Provide a better digital experience.

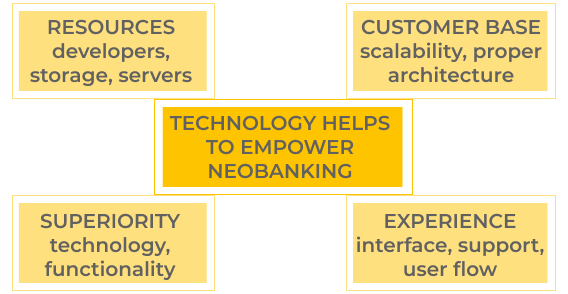

For all the challenges above, technology can be salvation:

- When lacking the resources, neobank can get support from professional software developers from Fintech that own needed storage, servers, and so on, alongside talented and skillful developers.

- The pressure of competing can be quickly overcome with expanded functionality or technological superiority. Give the users something they can’t have from the other digital bank, and they’ll become yours.

- A bigger customer base (except for the marketing efforts) can be supported with the proper system architecture to help numerous clients simultaneously.

- Regulations are what keep the financial sector running smoothly. And most of them are considered by your trusted software development vendor.

- A better digital experience is based on the following grounds: modern technology, proper software architecture, in-time technical support, security, following compliance policies, and wide functionality.

What should be done to make your Neobanking service number one?

- Business strategy

While consumers choose between neobanks and the challenges of free banking and digital tools they bring, banks need to focus on new ways to compete for the market and calculate the customer’s demand.

- Technology

Research the best technology for digital banking or hire software development vendors who aren’t new in the niche and know all the possibilities for engaging one or another tech solution. To bring your business the values you are looking for, they use ML and AI, explore the top languages, frameworks, integrations, databases, and best storages for 2021. - Financial experts

Get more information from financial experts from leading Fintech consulting firms, like Tal Sharon, Managing Partner at Equitech, and FinTech consultant who specializes in analyzing corporates and financial institutions’ requirements in their FinTech transformation process. Such experts will give you a solid understanding of your prospects and help you build a plan. - Trusted software development partners

Involve software engineers who know all about digital Fintech solutions, regulations, pitfalls, challenges, have significant experience, and provide quality services. UppLabs, of course!

How UppLabs can help

Regardless of your business, Fintech security practices are one of our priorities. Over the last seven years, we at UppLabs mastered the latest Fintech technologies and gained experience in creating reliable, secure, and sophisticated Fintech solutions and products:

- Fintech web and mobile development

We follow Fintech trends and innovations, continually learn, visit the best fintech conferences, and have the best team of professional web and mobile developers. - Money transactions platform engineering

Our fintech payment ecosystem is transparent and multifunctional. - Online trading and exchange platform engineering

We create online e-trading platforms that offer real-time solutions with various trading fintech opportunities. - AI-based Fintech solutions

We are ready to use AI-based solutions to collect and process huge volumes of data aggregated by Fintech companies. - Payment systems integration and optimization

We automate your accounting and ERP, creating the best fintech services and apps. - Existing services maintenance and modernization.

Our portfolio includes a modern architecture that guarantees easy maintenance and easy integration with the best fintech services.

If you need to disrupt the neobanking sector – ask UppLabs how!