Not sure how to choose the best fintech software development company? In this article, we will describe the factors to consider when choosing a custom fintech software development provider.

1. What are FinTech Solutions?

Fintech is an innovative industry of companies that use the latest technological developments to compete with traditional financial institutions.

Fintech often refers to the combination of finance and technologies used to process the business operations and financial services, whether it is software, a service, or a business that implements technologically progressive ways to make financial processes more efficient by introducing traditional methods.

Over several years of development of the Fintech industry, there appeared more than a dozen of solutions:

- Digital Banking – this business solution is almost the same as that of a bank with physical branches except that this model doesn’t require huge costs for manpower and real estate, that’s why customers can benefit from reduced rates.

- P2P lending is one of the most popular areas based on the possibility of lending without the participation of banks. Startups operate on the basis of distributed ledgers and help lenders and borrowers from the consumer and business sectors to profitably cooperate.

- Money transfers are Fintech startups that allow users to transfer money without the participation of banks. They use mobile platforms and simple authentication. The most popular money transfer solutions are Revolut Neobank, TransferWise (platform for cheap international currency transfers), Klarna (internet payments).

- Investment platforms are also called Wealthtech. They include robotic advisors, digital brokers, micro-investment platforms, and personal finance management programs. They work on automation and market accessibility for retail investors and are especially popular among investors due to predictive analysis and robotization.

- B2B Fintech is a direction designed to solve the problems of online money transfer and data exchange in business. Especially popular are smart contracts based on blockchain technologies.

- Big Data Analysis – there are now a big amount of Fintech startups working on Big Data for the financial sector. Advertising and PR have been using personal data in their activities for a long time, but the financial sector needs a more systematic approach.

- InsureTech is insurance offering automated products: mobile apps, payout automation, IoT interactions. For example, US auto insurance companies sell insurance on a “telematics” basis. This information can be used for the next insurance policy.

- PerTech is one of the most useful areas for business that allows clients to automatically adapt their business to changes in legislation, Fintech regulations, and market conditions.

- Neobank is a Fintech-based bank that operates digitally or via a mobile app and provides banking and payment services without the traditional bank infrastructure.

- The API-based bank-as-a-service platform is a backend that hosts independent Fintech startups and integrates them with any traditional banks. With the help of such platforms, financial institutions can easily start their products and bring them to new markets.

2. What kind of software is used in Fintech?

Each Fintech solution can provide software that meets the specific needs of the business.

There are such categories of Fintech software:

- Loan Origination Software

- Commercial Loan Software

- Online Banking Software

- Mobile Banking Software

- Insurance CRM Software

- Insurance Agency Software

- Investment Management Software

- Payment Processing Software

- Personal Finance Software

- Financial Risk Management Software

- Financial Fraud Detection Software

Below, we can research in more detail the software you can develop for your business goals.

3. What types of Fintech software can you develop

Based on our experience, we collected some of the most promising types of Fintech software and explored their features:

3.1. Billing and Payment Software

Billing and payment software helps businesses manage accounts for payment and receiving money transfers from different departments. This kind of software allows to automate the most time and resource-consuming operations and diminish the manual data errors.

3.2. Expense Management Software

You can use the expense management software to operate, process, transfer, and pay the expenses for the employment process. The software provides the opportunity to automate and ease the expenses, makes the administrative work easier, analyzes cost-saving opportunities, integrates with existing payment, accounting, and time tracking software reviews expenses before their submission.

3.3. Investment Software

With the help of investment software, the customers can improve their investment decisions, as the system allows them to access their analytics, investment predictions, and data management. The software operates the transactions, makes reports, and shows the financial statements using visualization.

3.4. Financial Planning Software

Financial planning software usually is linked to the client’s bank account. This kind of software provides clients with detailed financial data gathered in one place. It helps clients to track and plan their financial operations and budget.

3.5. Blockchain-based Solutions

Blockchain-based solutions usually deal with issues of ownership and smart contracts. These solutions serve different lending products, including credits, mortgages, and consolidations loans.

3.6. Insurance Software

The insurance software usually needs to comply with international and national regulations. The software provides the clients with profitability opportunities, costs and revenues, executes insurance quotes, monitors and manages the current state of insurance policies.

4. What does a financial software developer do?

The financial software developer’s primary task is to provide financial software development services and be an expert on specialized software products. The Fintech developer has to know how to implement stable and secure solutions for your product and be aware of the new trends.

A financial software developer is responsible for the modification and updating of the software programs for the finance and banking industry. Such specialists can work with different businesses, developing any product from insurance software to mobile investment solutions.

5. Why Outsource Fintech Software Development?

Despite the fact that outsourcing in the financial sector is subject to many regulations, and most financial companies prefer internal development, this type of cooperation is becoming more popular.

In today’s world of technological innovation, it would be difficult and time-consuming to build financial technology from scratch. Technological outsourcing solutions are cheaper, faster, and more reliable for Fintech startups.

IT outsourcing services range from complete technology infrastructure to the development of a specific part of applications. Fintech’s outsourcing development is becoming a common practice of cloud technology.

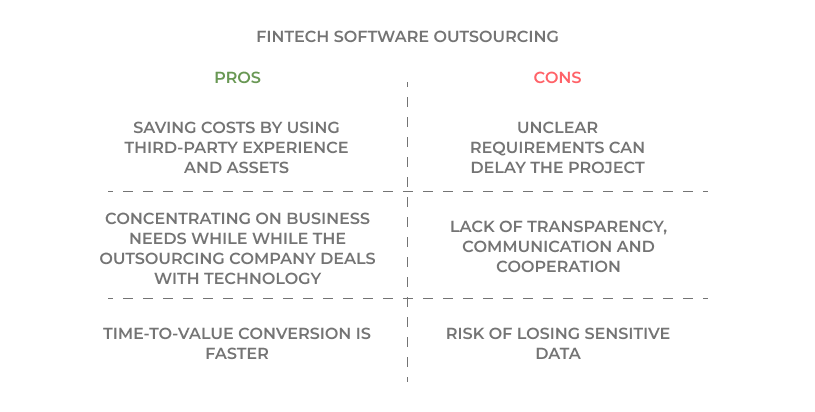

Among the benefits of Fintech software outsourcing are:

- Financial companies can save costs and use third-party experience and assets to adapt to technological progress.

- Newly built Fintech startups can easily organize their business development needs, while the outsourcing company deals with technology.

- Focus on core business activities.

- The time-to-value conversion is faster.

The drawbacks of Fintech software outsourcing can be:

- Unclear requirements can delay the project.

- Lack of communication and cooperation can interrupt the development process.

- Lack of transparency.

- Risk of losing sensitive data.

6. How to hire a Fintech Software Development Company

The most important part of custom Fintech software development is finding the right software project partner. With thousands of options, ranging from established development companies to freelancers, the choice can be daunting.

Before delving into the selection process, consider the following tips. They will help you avoid mistakes and make the right choice.

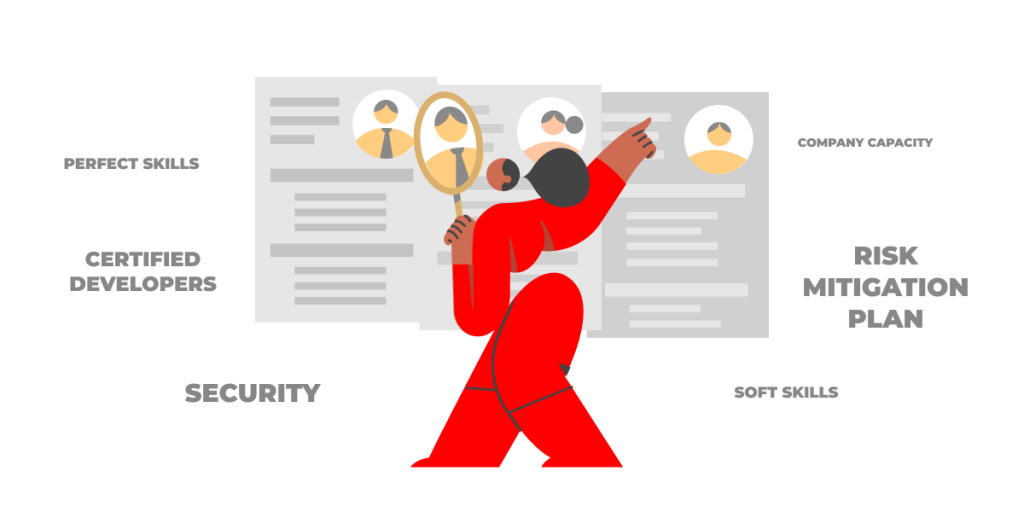

6.1. Perfect Skills

The portfolio of the Fintech company has to include examples of the technologies the team uses, and the modern architecture that guarantees easy maintenance and easy integration with the best Fintech services. When it comes to financing, it is important not only to understand the current situation but also to analyze it, make predictions for the future, and draw concrete conclusions.

6.2. Certified Developers

The Fintech expertise should be experienced and have the necessary certifications, Fintech domain knowledge, and technical expertise. In order to provide you with top-quality software development, the team has to master the skills and gain experience in creating reliable, secure, and sophisticated Fintech products.

6.3. Security

Secure identification and authentication can be critical for Fintech software. The Fintech industry is an area that requires the greatest precision and safety in all data and operations. Companies use financial solutions software to improve employee productivity, customer satisfaction, and overall business performance. Correctly selected Fintech solutions will make life easier for all parties of interaction and make most of the processes automatic.

6.4. Company Capacity

The size of your Fintech company has to meet your business goals. You should be confident that you will have all the specialists you need at different stages of the development process. The Fintech company has to provide engineers and other IT specialists of different levels for your project tasks. Having one team of developers for the entire Fintech development process is a great benefit as you don’t need to spend lots of time getting maintenance and setting all development processes of the team again. It’s also more cost-effective.

6.5. Risk Mitigation Plan

Risk management is especially needed in Fintech projects. It is a decision-making tool needed for evaluation, identification, and determining risks aimed at minimizing the possible losses of the project caused by its implementation. The risk management process should begin with the understanding that:

- any profit is accompanied by risk;

- the higher the risk level in this market segment, the higher is the rate of return;

- due to the presence of risks, you can take your place in the market;

- risks are allies of one who knows how to manage them.

6.6. Soft Skills

Correctly selected Fintech solutions will make life easier for all parties of interaction and make most of the processes automatic.

Regardless of the Fintech business model your business follows, UppLabs is ready to help, as we mastered the latest Financial technologies and gained experience in creating reliable, secure, and sophisticated Fintech solutions and products. We have strong knowledge of trends, innovations, and new business models, we constantly learn, visit the best Fintech conferences, and have the best team of professional web and mobile developers.

If you’re looking for a Fintech development partner – there is no point in further search! Check our expertise here.

UppLabs is a perfect companion to lift you Upp!