The Internet and the transfer to online businesses contributed to the rapid growth of world trade over the years. Therefore, most financial institutions and payment systems have developed cross-border payments to facilitate and speed up money transactions.

The trusted and reliable banking approach came across the challenges from rising solutions, so the new players and models are modifying the fintech world. In this article, we would like to tell you how cross-border payments changed the foreign payment system and created a new paradigm.

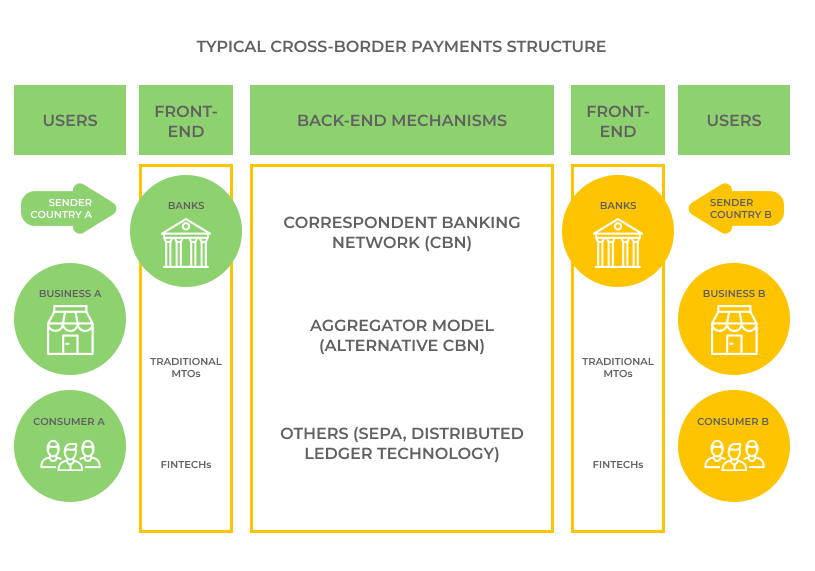

Сross-border payment structure (or How do cross-border payments work?)

Cross-border payments are transactions that involve transferring money between people and businesses from one country to another. They are carried out through financial institutions and the correspondent banking network (CBN) that are directly related to sending and receiving funds.

In the beginning, cross-border payments were considered to be slower, riskier, and more complex. However, more companies and individuals today rely on them more than ever before.

It’s essential that the chosen gateway could be easily integrated with a range of payments and currencies, so it will be possible to get to the new markets. The option of making card transactions with a local currency will lead to better acceptance rates. Usually, when the customers make the shopping online, it’s easier for them to see the final price in their currency. The transparency of the currency ensures that the customers will use this gateway the next time.

Among the types of cross-border payments are:

- Credit card payments

- APMs (Alternative payment methods)

- International wire transfers

- International ACHs (The Automated Clearing House Network run by the National Automated Clearing House Network (NACHA)

- Prepaid debit cards

- PayPal

How can we benefit from cross-border payments?

The modern world economy is characterized by positive trends such as globalization and growing population mobility. All of this contributes to the continuous growth of the need for cross-border payments. Therefore, among the main advantages of cross-border payments and settlements are the following:

Minimization of fees

People used to the fact that most of the cross-border transactions usually involve huge fees. Bank transfers to other countries most often include commissions from both the sender and the recipient.

Not only does it take longer, but it also costs more because there are more participants involved (the local bank, the foreign bank, and the bank transfer systems of both banks).

Now, with the use of modern fintech technologies, users can take advantage of the cross-border transaction process. In comparison to the traditional banks, the use of modern cross-border payment systems is usually significantly cheaper or sometimes can be free of charge.

Hidden fees in the exchange rates

The foreign payment system offers fixed rates for sending money. With fixed exchange rates, the value of a country’s currency is specified with the value of another country’s currency. In fact, this should guarantee the stability of the exchange rate and exclude sharp currency fluctuations.

The broader global coverage

Moving funds has become more accessible, enabling broader ensured payment coverage in hundreds of countries. The ease of the process includes:

- faster and simpler payment channel;

- the process takes only a few minutes instead of a few days;

- ease of access allows individuals and legal entities to move funds anywhere and anytime, using only a device connected to the Internet.

Some statistics of cross-border payments

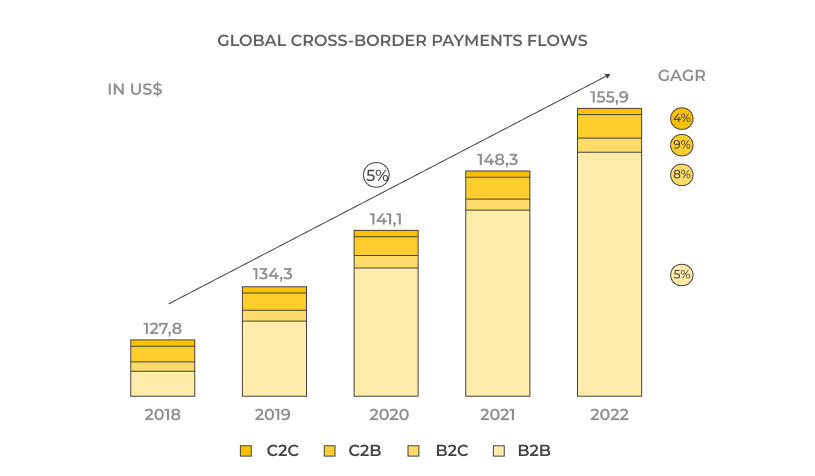

- Expected global cross-border payment flows in 2022 is expected to be US $156t;

- Cross-border payments revenues reached $1.9 billion by the end of 2020;

- A Forrester study predicts that by 2022, the cross-border eCommerce will extend across at least 29 countries of North America, Latin America, Europe, Africa, Asia Pacific, and the Middle East;

- According to the World Bank, since 2019, emerging markets and developing countries have received over half-billion US dollars in cross-border payments;

The global cross-border payment flow in total is expanding around 5% (CAGR) a year.

Cross-border payments regulations

Each country has its own set of laws, regulations, and reporting requirements that govern cross-border payments. As a result, the more payments from different countries you accept, the more complex the legal requirements become. For example, some countries, such as China and India, tightly control the money leaving their border.

Another critical point is the purpose of the payment and the amount of money the sender would like to transfer. It can be necessary to provide particular regulatory or banking forms to make a payment.

International standards are determined by EU directives and other regulations governing cross-border payments regulations, which address:

- issues of banking law coordination;

- services for conducting payment transactions;

- protecting the interests of participants in cross-border payments systems;

- functional characteristics and safety of settlement funds;

- creation of legal protection for participants and clients of cross-border payments systems;

- Standard European norms for cross-border payments transfers;

- legal standards of final mutual settlements in payment systems;

- acceleration of cross-border payments transfers;

- improving the transparency of payment turnover for clients;

- equality while paying for cross-border payments transactions with the same transactions within the country;

- rules for cross-border payments securities;

- international agreements governing the regulations of bills and check circulation.

The EU created a Single Euro Payment Area (SEPA) to simplify payments between their member states. An example of EU Regulation for cross-border payments is the Regulation (EC) No 924/2009 that was accepted in the context of the Single Euro Payments Area (SEPA). It asks banks to apply the exact charges for domestic and cross-border electronic payment transactions in euro.

The new laws detailed under PSD2 (Payment Services Directive) will work for the cross-border payments made within the EU. If at least one part of the payment journey is outside of the EU, the cardholder will not have to experience the two-factor authentication process. But the rule will apply for customers making cross-border payments from one EU Member State to another. It ensures a secure transfer and created a single digital market.

The Regulation offers rules on cross-border payments within the Community, allowing the same charges and currency for cross-border payments within the EU. The Member States can declare their decision to extend the application of this Regulation to their national currency.

Trends reshaping cross-border payments

The constant changes of the cross-border payments process lead to new business models and new trends that modify the world transactions volume. The trends we now can predict are:

- Consumer demands are changing rapidly

The banking services are expected to become more flexible and fast, while the consumers are less likely to pay for additional banking services. The developing era of smartphones and quick alternative payment methods (APMs) raised the demand for cross-border payments quality to a new level. The new providers come with new cross-border payments solutions and offer cheaper and more transparent advantages than the banks.

- Trade with emerging markets

Another increasing trend of cross-border payments is the switching focus on new international markets in Latin America, Africa, and Asia. There is a prediction of increasing cross-border trade by 5% (CAGR) until 2022 from global markets powered by initiatives like the African Continental Free Trade Area and China’s Belt and Road Initiative. While in western markets, there is a slight growth of around 2% (CAGR) caused by the changing political situations, including Brexit and US trade tensions.

- More world access to the mobile phones and e-payments

With the rise of phone accessibility and switch to the remote way of life, more customers discovered that e-payment solutions could bring more benefits and save their time. In 2021, the number of smartphone users worldwide raised to 3.8 Billion, which means 48.20% of the world’s population. This figure is predicted to increase every year. Overall, the global wallet at the POS (point-of-sale) is expected to increase to 52% in 2023. All this will lead to the development and more accessibility of cross-border commerce volumes.

- A wide range of electronic payment providers

All over the world, there is increased popularity and demand for electronic payments. Many electronic payment providers currently maintain services for storing, money exchanging, money transferring, and payments. Each provider has its own strong and weak points, so there is no definite answer to the question of which one should be entrusted with your funds.

Fintech and cross-border payments

The global trend of Fintech development at the moment is digitalization, automation, and informatization. These are pillars of modern development programs in many countries. Cross-border payments are no exception. Solving the problems of transferring operations often depends on the implementation of blockchain technologies, big data, and many other innovative systems.

New alternatives for fintech settlements improve the overall efficiency of cross-border payments. These include:

- interconnections between internal payment infrastructures;

- the expansion of closed systems across borders;

- blockchain-based peer-to-peer payment solutions, also known as Distributed Ledger Technology (DLT);

- CCPS (Cross-Carrier Payment Systems) work in mobile operators’ networks and conducts cash transactions in real-time.

The payment system in the blockchain systems uses Rich Communications Services (RCS) protocol, an advanced SMS simulator that can transmit multimedia data and perform service discovery. Thanks to the presence of RCS, customers will be able to use applications on their mobile devices for cross-border payments and don’t need to change the currency at the bank.

There are other solutions as well. Such companies as IBM, KickEx, and Stellar are developing cross-border payment systems based on blockchain technology. Corporations are trying to create full-fledged platforms for transactions between Asia, Australia, and Europe.

The companies are also developing systems for transferring funds using mobile networks. However, such payment systems are just the beginning of distributing blockchain solutions for the communications sector. They also plan to deal with another important aspect of financial transactions – security issues. It requires the development of concepts of identification and client authentication.

The future of cross-border payments and a new paradigm

International payments have long been a power enabling cross-border trade and investment in today’s global economy. The banks deserved the reputation of cross-border market owners, while the great list of requirements such as regulations and technical infrastructure has prevented international trade from developing fast.

Today, the demand for cross-border payments is so high that we can observe a new paradigm of changes that lead to the general improvements of the whole cross-border payments landscape. Here are some of the most brilliant examples of the future cross-border direction.

- The growing role of SMEs in international business

The SMEs (Small and Medium Enterprises) have started to benefit more from the simplification of cross-border payments, as they have more access to affordable solutions, giving more flexibility in their options (like SWIFT or Mastercard). The traditional banks are no longer able to fulfill this fast access to international payments.

- Global eCommerce

With the development of e-commerce, there is an increase in the number of payment systems. They become faster, which leads to a decrease in cash transactions in the world. As businesses and consumers have grown accustomed to faster, cheaper, and more convenient payments, customers’ expectations are higher. It has helped drive innovation in interface systems that improve the user experience with mobile technology, e-wallets, and e-commerce.

- A Single Global Payment Area

The example of a Single European Payment Area (SEPA) shows the considerable benefits for the European trade, bringing more transparency, security, liability, efficiency, and quality customer services. Open banking is becoming a standard that customers are getting used to.

- New standards and infrastructures

Modern, open, and globally implemented standards are crucial to ensuring an instant and easy cross-border payments comparable to internal payments. The transition of payment systems in Europe, the USA, and the UK to the open standard ISO 20022 in November 2021 will push the development of integration both within and between countries.

The use of this standard will allow banks to make instant cross-border and domestic payments directly to the accounts of final recipients. It will enable the markets with the lower turnover to develop faster and reach the international level. And for larger markets, it will create conditions for making payments across the entire set of currencies in real-time within the market between banks, various payment service providers, card schemes, a gross settlement system, and local clearinghouses. Moreover, this standard will create long-term prerequisites for the introduction of new technologies in the financial industry.

How UppLabs can help

Regardless of your location, Fintech regulations for cross-border payments should be thoroughly examined as almost every Fintech solution, and standard developed these days can go globally.

Also, you should be sure to partner with developers that are aware of Fintech development standards and limitations.

Over the last seven years, we at UppLabs mastered the latest Fintech technologies and gained experience in creating reliable, secure, and sophisticated Fintech solutions and products:

- Fintech web and mobile development

We follow Fintech trends and innovations, constantly learn, visit the best fintech conferences, and have the best team of professional web and mobile developers. - Money transactions platform engineering

Our fintech payment ecosystem is transparent and multifunctional. - Online trading and exchange platform engineering

We create online e-trading platforms that offer real-time solutions with various trading fintech opportunities. - AI-based Fintech solutions

We are ready to use AI-based solutions to collect and process vast data aggregated by Fintech companies. - Payment systems integration and optimization

We automate your accounting and ERP, creating the best fintech services and apps. - Existing services maintenance and modernization.

Our portfolio includes modern architecture that guarantees easy maintenance and easy integration with the best fintech services.

Here, you can read the real-world Fintech case studies that we implemented, including rebuilding legacy solutions and payment systems.

You can also be sure that by partnering UppLabs, you partner with developers experienced in Fintech development standards and limitations.

Let’s talk about your Fintech opportunities!