“Banking is necessary, banks are not,” was once stated by Bill Gates. It is very accurate for online lending, also known as peer-to-peer (P2P) lending, which empowers borrowers and lenders to make money transactions directly via the Internet without using banks or other financial intermediaries. In this article, we will dive into the technical side of the P2P solutions and give you an example of modules, necessary for such platforms, and regulations you need to follow if you want to create your own.

1. What is P2P lending, and how does it work?

P2P lending is a financial transaction that involves an investor who loans money directly to a borrower through an online platform. In this model, individuals can lend to other individuals or businesses without any financial institutions. Online platforms accumulate all kinds of lenders and borrowers, allowing them to meet and offer mutually beneficial terms. In this way, potential lenders and borrowers register on P2P platforms – Internet resources or programs – and conclude loan agreements, deciding on their terms and negotiating debt and repayment terms.

The first intermediary company operating under the P2P concept appeared in the UK in 2005. Since its inception, Zopa has provided more than €278 million in loans and has become the largest P2P operator in the UK with a half-million customer base.

In the United States, P2P platforms have been operating since 2006. The American largest platforms, Prosper and Lending Club, have issued more than $5.5 billion in loans and have grown by 84%. By 2025, the P2P lending industry is predicted to reach $150 billion or more. Among the leading players in the P2P SMB lending space are Kabbage, Funding Circle, and OnDeck. OnDeck launched in December 2014 and claimed a market valuation of $1.8 billion, while Kabbage has stood up $135 million in seed funding at a valuation of $1 billion. The Funding Circle has brought up $150 million from investors at a valuation of $1 billion.

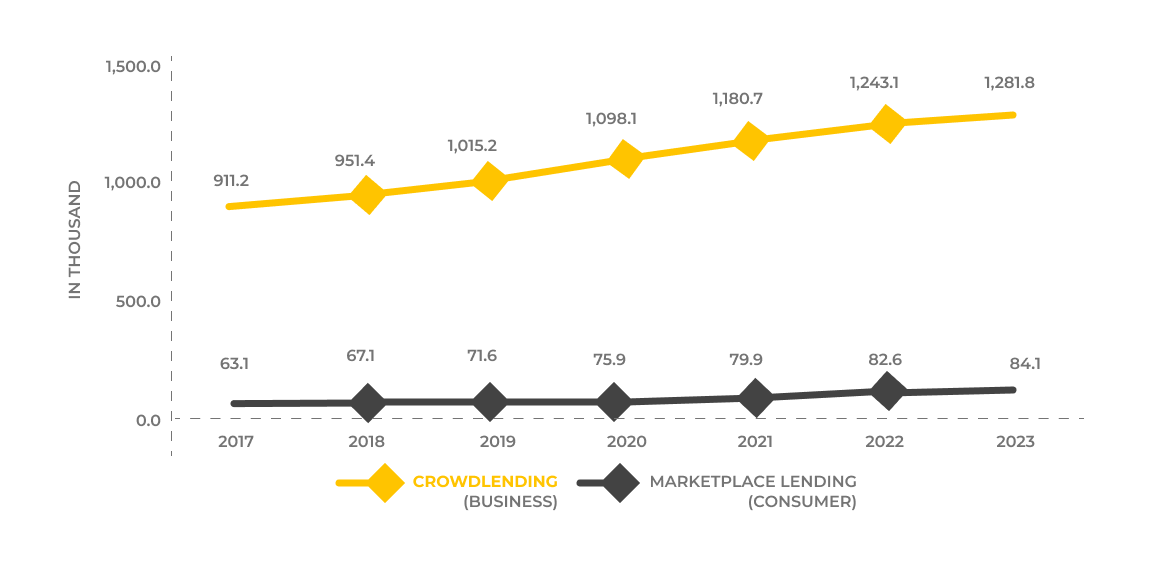

In the Crowdlending (Business) segment, the number of successfully funded alternative loans is expected to amount to 84.1 thousand by 2023.

2. P2P lending regulations in the US

The regulation of P2P lending in the US is disintegrated. Different government bodies are responsible for investing and borrowing side of these platforms. The Securities and Exchange Commission (SEC) is in charge of the investing side, while the Consumer Financial Protection Bureau and the Federal Trade Commission monitor the borrowing side. Some principal regulations issues need to be highlighted:

- The SEC bans the P2P platforms from crediting the direct borrower’s loan to the lender. It prevents the American P2P lending platforms from functioning as good matching platforms as the lending platform asks a bank to issue a loan from the platform to the borrower. The platform then gives out debt security to the lender, who is now a creditor of the platform.

- The new entrants have their regulation rules. They need to get a license from the state government, which can be costly and protracted, and then they have to register with the SEC. Once they are noted, they have to fulfill strict reporting procedures. It requires a substantial amount of work by the platform, which faces strict reporting requirements once registered.

- As legal lenders, the lending platforms are responsible for complying with laws regarding the loan, explaining the declination of credits, and avoiding unfair debt collections.

- The e-commerce transactions are usually regulated by NIST SP 800-63 Digital Identity Guidelines, which provide an overview of general identity frameworks, with the help of authenticators, credentials, and assertions working in a digital system risk-based process of selecting assurance levels. NIST SP 800-63 reveals how an individual can solidly authenticate to a CSP (Credential Service Provider) to access a digital service or set of digital services.

The two largest platforms, Prosper and Lending Club, prevail over the market. The new platforms’ appearance often becomes a complicated process because of the registration procedure at both federal and state levels. The innovative business models are hard to implement, so only a tiny percentage of P2P lending goes to businesses in the US.

When creating a P2P lending platform, it’s essential to comply with all government regulations. For these purposes, we recommend hiring a lawyer, work with banking professionals and conduct a comprehensive loan agreement.

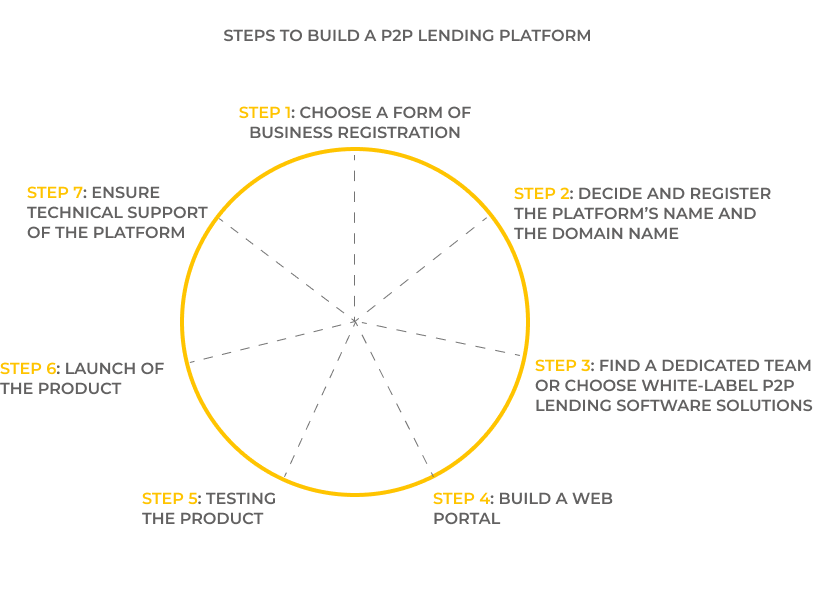

3. Steps to build a P2P lending platform

The lending platform should be reliable, usable, solid, and support many languages to increase the reach of the audience. It can be challenging to build such a platform, but it will be successful if you choose the approach wisely. So, here are the steps you need to include in the development of the P2P lending platform:

Step 1: Choose a form of business registration

The business registration form guarantees a platform’s liability and protection in case of any force majeure. The tax procedure depends on the conditions of registration. Still, an LLC (limited liability company) has the right to choose the status of its taxes and has an option to pay as a corporation. Large corporations have to share profits and losses following the participant’s ownership.

Step 2: Decide and register the platform’s name and the domain name

While choosing the platform’s trademark, you need to consider the country user’s reviews or the company’s state. Before determining the last name, make sure this name is accessible by checking the United States Patent and Trademark Office website. The chosen name shouldn’t be the same as the domain name and may contain the description of the company’s activities, so the potential users can quickly get an idea of your business.

The platform’s website address should be clear and short. It’s essential to pick up the unique and free name and pay some amount of money depending on the domain zone ($20 to $100).

Step 3: Find a dedicated team or choose white-label P2P lending software solutions

You can build your platform from scratch or choose to start with white-label P2P lending software solutions that can be customized. If you decide to use ready open source software, you need to research which one is more fit for creating unique credit products and check the reviews of the users. Such development can take from 2 to 6 months, depending on the budget and the number of features you want to implement. The full-cycle development can take from 5 to 12 months.

Another option is to choose the best team and build the product from scratch. Here are some of the main things to follow:

- The team should be motivated and be focused on long-term cooperation;

- The team should consist of fintech experts, experienced in law, banking, marketing, and who knows everything about credit;

- All specialists and processes should be ready and be in place;

- The communication between the team members should be efficient

- The whole teamwork should be easy to synchronize.

Step 4: Build a web portal

The web portal for P2P lending needs to have integrations with as many payment gateways as possible. It should have a simple and straightforward interface and several language options. While using the white label solutions, you may find some basic website designs, but if you want to have an exclusive and one-of-a-kind product, be creative and think of something exceptional.

Step 5: Testing the product

Testing the website is an essential part of the process. The testing team should check the platform’s security, personal data, and the payment getaways’ encryption. The potential user should understand how to register and apply for a loan in the double-click. The team also needs to test the platform’s performance on different devices and use the necessary tools to enhance it at low speed.

Step 6: Launch of the product

That’s the stage where you need to involve the marketing team and manage the campaign, finding potential users, investors, and borrowers, offering interest rates, and loyal loan plans. It’s essential to be careful and use user identification algorithms as it’s a niche that connects with money which attracts lots of scammers and hackers.

Step 7: Ensure technical support of the platform.

There is always a chance that something can fail to work even if you tested or debugged it hundreds of times. And that’s where you need a prompt reaction from a support team that should be ready to solve any arising problem. The quick support team will allow you to detect and exterminate the bugs and understand what needs to be improved in developing the whole platform.

If you don’t rely on the investors entirely, you need to raise money for the first loans, the website, and additional operating expenses. The initial amount of capital can depend on the development process, experts, and marketing. But the general price for the P2P platform ranges between $15–300 thousand. Among the most popular options to collect money are:

- Use the Security Token Offering (STO) – initial offer of tokens and a startup algorithm that implicates registration with the SEC and the crowd sale itself. This option offers you to generate tokens that can bring profit and cut down commissions.

- Attract venture capital by bringing a business plan to business angels – potential investors and shareholders.

- Take on the bank loan.

4. P2P lending requirements specification

Online lending platforms connect borrowers and investors and allow them to fulfill money operations and loans. Some P2P lending sites also offer borrowers and investors to make their deals in interest rates and loan tenure. While developing such a platform, you need to consider all possible features and details (such as loan calculator, auto investing, ISA/IFISA support, secondary markets, etc.)

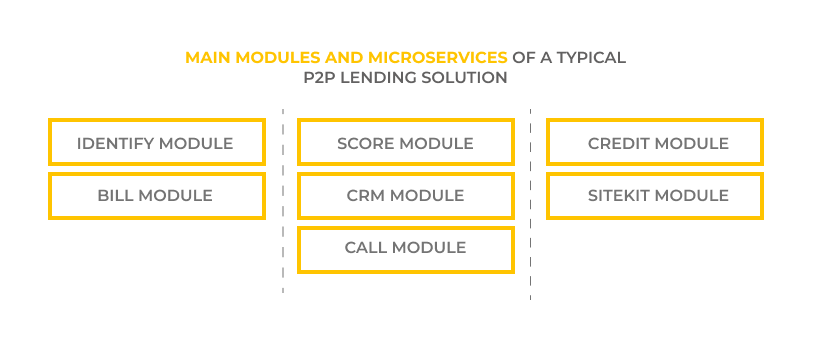

A typical P2P lending solution may consist of the next main modules and microservices:

Identify Module

- 3D/2D Liveness Detection for client identification protection against hacking biometric systems. Algorithms detect attempts to use fake photographs, 3D/2D masks, or images on the screen of the gadget instead of the human face.

- Video Stream Liveness Detection determines the reality of a person when calling a manager via video stream.

- Recognition of documents in the photo (determination of the document and comparison of the client’s image by getting parameters of the similarity of two faces in the photo)

- Receiving documents by scanning and ability to recognize key identification parameters of ID passport and other client’s document data.

- Bank ID to verify clients through banks to provide administrative and other services via the Internet

- Financial monitoring of the client’s financial transactions and its compliance to his financial state, client risk assessment according to the provider’s database or another source of information.

- Client/employee digital signature.

Score Module

- Credit scoring for MFIs (microfinance), reporting, and analytics.

- Credit decision-making system for banks/MFOs that allows providers to apply scoring models and credit policies to form a loan decision, and also acts as an intelligent router for the flow of applications for products, promotions, and A/B testing profiles.

- Customer identification scoring that allows automatic status affixation of the applicant, based on analysis of available databases and statistics.

- Individual credit reports from the Bureau of Credit Histories.

- AI&ML for making business decisions with mathematical precision based on big data analytics from open sources.

- Assessing device risk and protecting users by analyzing non-personal data.

Credit Module

- The automated accounting system for financial companies (AFS), a complex of software and hardware aimed at automating financial activities.

- API for existing clients’ base migration with payment, fee transfers, and credit product transfers.

- Automatic payouts to a customer’s card via gateways (Portmone, IPAY, and analogs).

- Available integrations with 1С, ProFix, Lime systems, and others.

Bill Module

- The system of loan repayment through online services, self-service terminals, and cash banks.

- Integration with popular payment systems.

- Availability of repayment via terminals.

CRM Module

- The CRM system keeps a full record of applications for credit products with the ability to track and record the status of the application, a complete history of interactions with the client.

- The ability to customize actions in work with the client, send to a contact center, invite to a branch, send SMS/IVR, send the customer to a partner.

- Scripts can be customized individually, according to the customer’s business.

- The system provides information about mass mailings, triggered mailings, automated IVR/IVM, implementation of printed forms, GSM Gateways, generation of unique user links to attract new customers to the product and payouts, and provides bonus code constructor.

Sitekit Module

- Financial company website constructor that allows to launch the website in 1 day, and includes lending, borrower’s dashboard, investor dashboard, personal information, document output, application system, and credit calculator.

- Integration settings constructor (CPA) with traffic/lead generators allows users to complete the integration in 30 minutes.

- API Ready for Leads includes an interface for connecting partners who can send requests directly to the system without directing the client to a URL.

- SEO page configuration constructor

CALL Module

- CRM for customer credit debt management.

- Robotic Contact Center, which provides an effective study of the base of customers.

- Access to the application for the group of users “Collectors” with a separate interface and the ability to filter the credit portfolio by the following parameters: sum, number of days overdue, automatic lists for IVR, SMS, email, and push notifications, the configuration of scripts for reports, document workflow, other customizable parameters

These are examples of modules. They may vary depending on the functionality, complexity, team, and initial budget, but usually, they are grounded on the exact lending mechanisms, like potential users’ information, registration of borrowers and lenders, ID card number, bank account, personal data in third-part credit institutions, credit scoring, CRM, etc.

5. The P2P credit application of the borrower

The whole credit process goes through several steps, like application, acknowledge, credit, approval, assign, and loan management. In the application process, P2P lending needs detailed information.

6. Top 2 P2P Lending Solution Providers in 2021

The P2P lending market contains hundreds of platforms. And each year, more and more new different lending platforms go to market. We decided to collect some of the best solution providers of this year:

- Peerform is a platform that uses algorithms to grade applicants with more credibility.

Peerform provides borrowers with damaged credit an alternative to high-interest payday loans and other financial products, such as fee-laden credit cards.

Peerform’s best rate is 5.99% and one of the lowest in the market, with its maximum APR offering a comparatively low rate of 29.99%.

However, Peerform charges such fees as a 1% to 5% origination fee and a 5% late fee. These fees are within the normal range among lenders who charge them, but not all other platforms use them. Additionally, the platform’s personal loans are only available in three-year terms. While there aren’t any penalties for paying your loan off early, it will be problematic if you need to postpone your payments.

Among the main points:

- Loan amounts are $4,000-$25,000

- Fixed APR Range is 5.99%-29.99%

- Loan Terms are three years

- Origination Fee is 1%-5%

- Late Fee is 5% ($15 minimum)

- Minimum recommended FICO score of 600

- UpStart. This lending platform uses academic and employment credentials to search for potential borrowers, even if they have imperfect credit histories.

Their motto is “You are more than your credit score,” which means users don’t even need to have a credit score to get funding. But If they have credit experience, they will need at least a 600 credit score. And even more, If they share unconventional information like the university they attended, the area of study, they can get a lower rate from a traditional lender.

Upstart’s lowest APR is relatively low, and there are no origination fees to borrowers with the strongest applications. Of course, not everyone may be approved. Upstart also can charge some borrowers origination fees as high as 8%, which is 2-3 percentage points higher than the maximum assessed platforms. They also don’t accept any co-signers.

Among the main points:

- Loan amounts are $1,000-$50,000 based on credit, income, and other information

- The typical APR Range is 8.94%-35.99%

- Loan Terms are 3 and 5 years

- Origination Fee is 0%-8%

- Late Fee is 5% ($15 minimum)

- Time to Receive Funds is usually one business day after acceptance for most loans, two if you accept the loan offer past 5 p.m. EST.

- A minimum score of 600

P2P lending solutions are generally regulated, the rules are clear and controlled by the central banks of each country. All of the platforms listed above can provide detailed information about the service they offer and are transparent to overcome the distrust of future users. But keep in mind that platforms with more guarantees and lucrative tax programs usually offer a lower interest rate. More aggressive decisions that claim high rates can lead to problems with loan repayments for months or even years.

The P2P lending market is growing by almost 30% annually. Demand for cheaper and more affordable loans in troubled economies is always high because bank loans are too expensive. Thus, P2P lending platforms have already become part of the financial market, offering attractive investment instruments to individuals and institutional investors.